- Infographics:

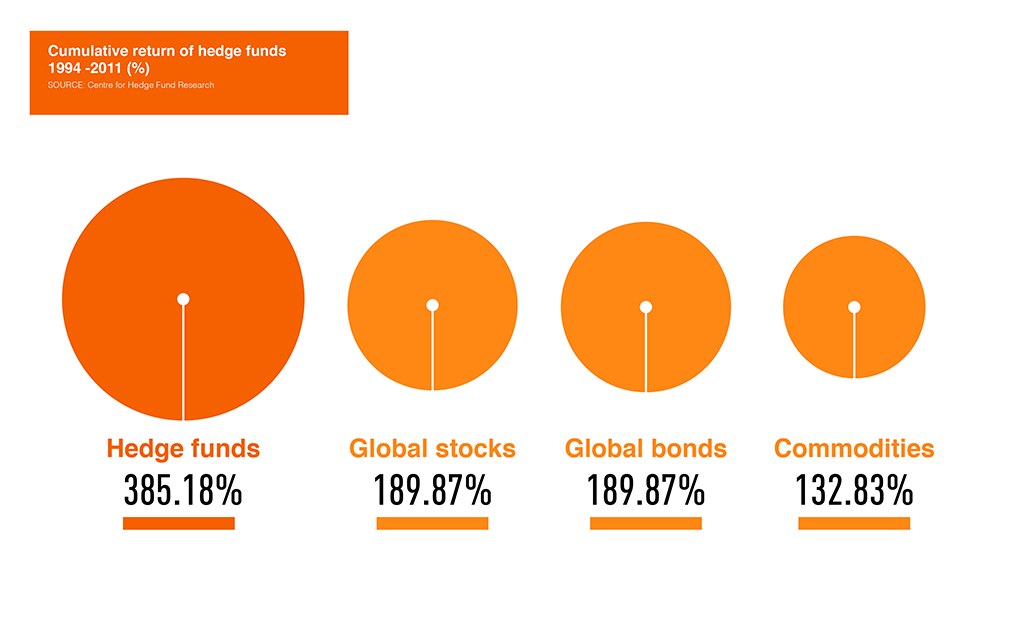

- Cumulative return

- |

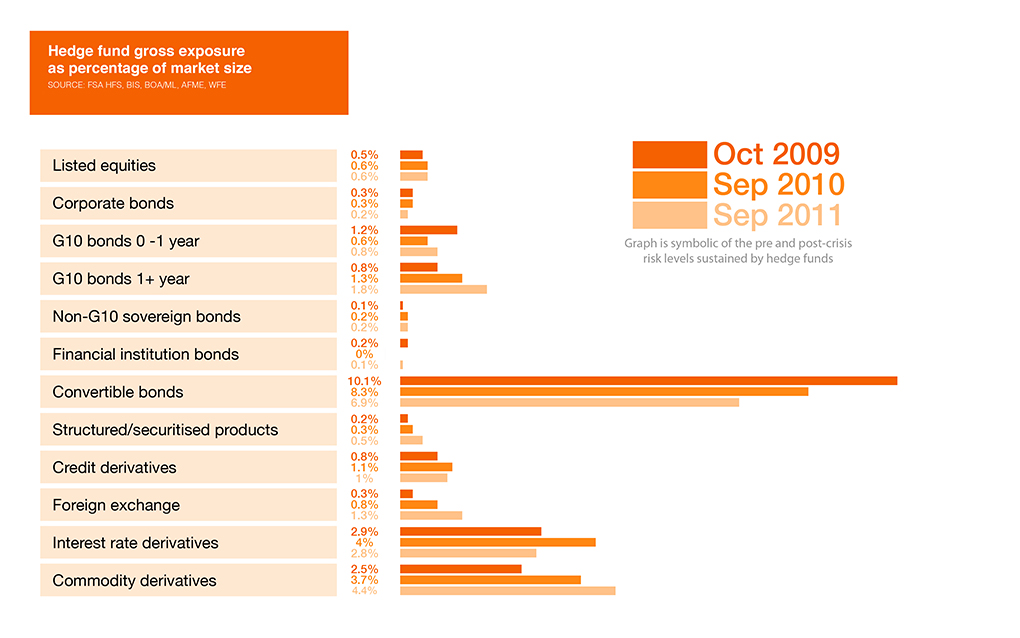

- Gross exposure

- |

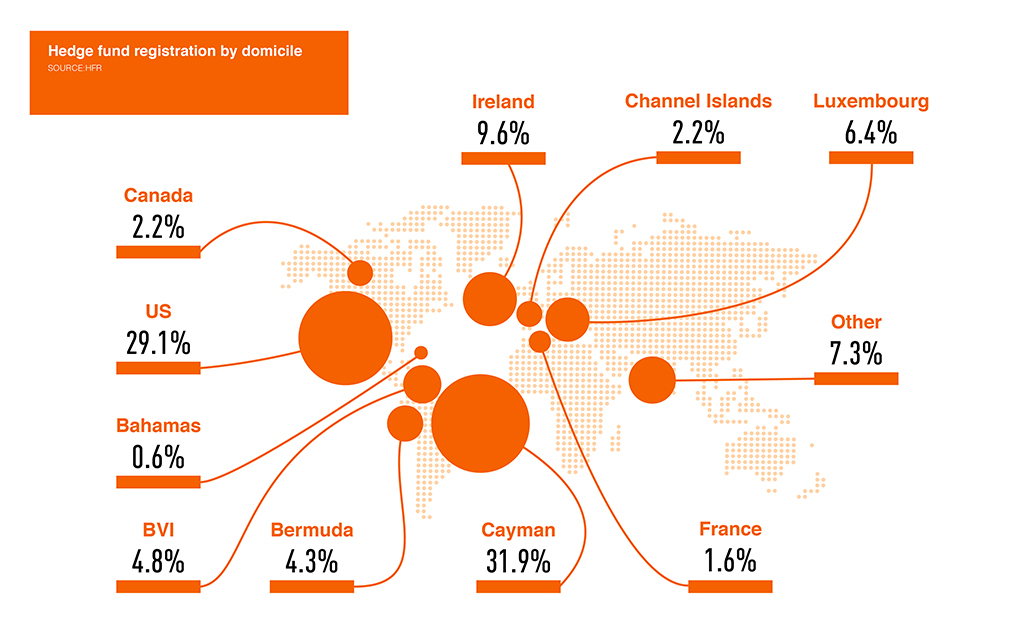

- Registration

- |

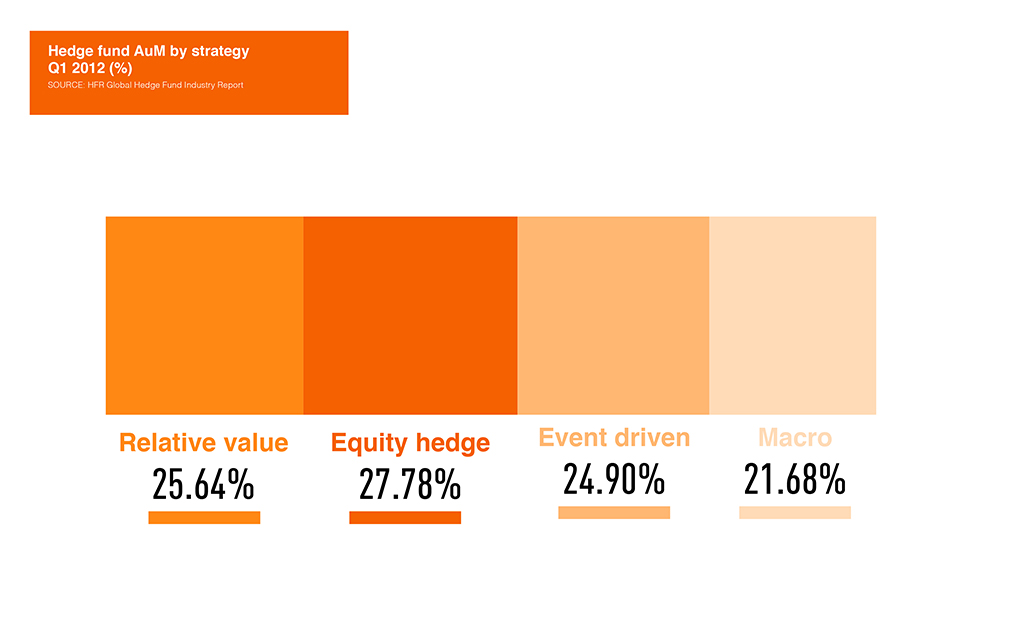

- AuM by Strategy

- |

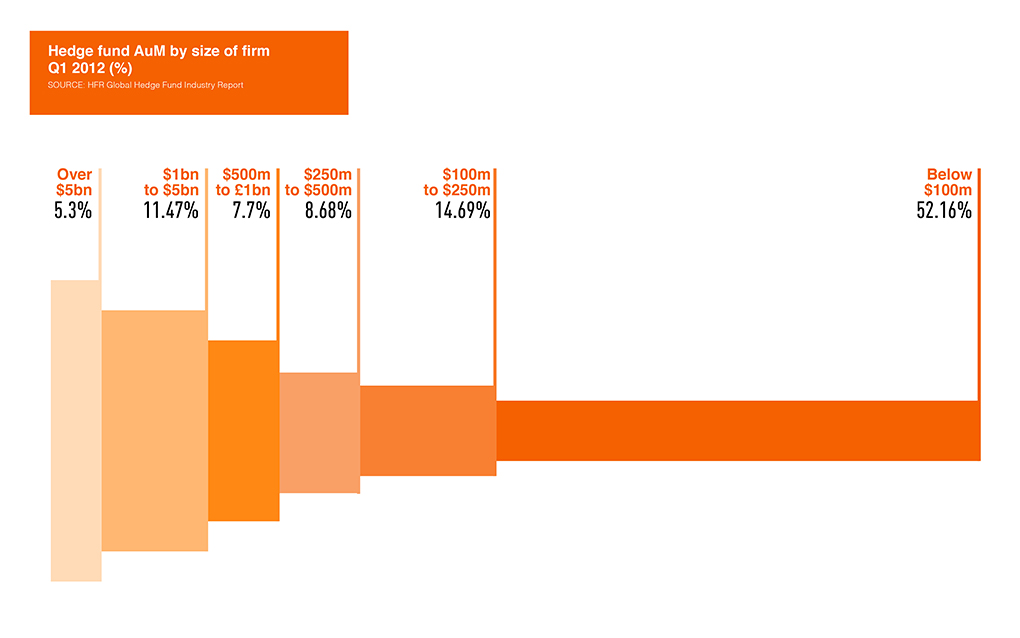

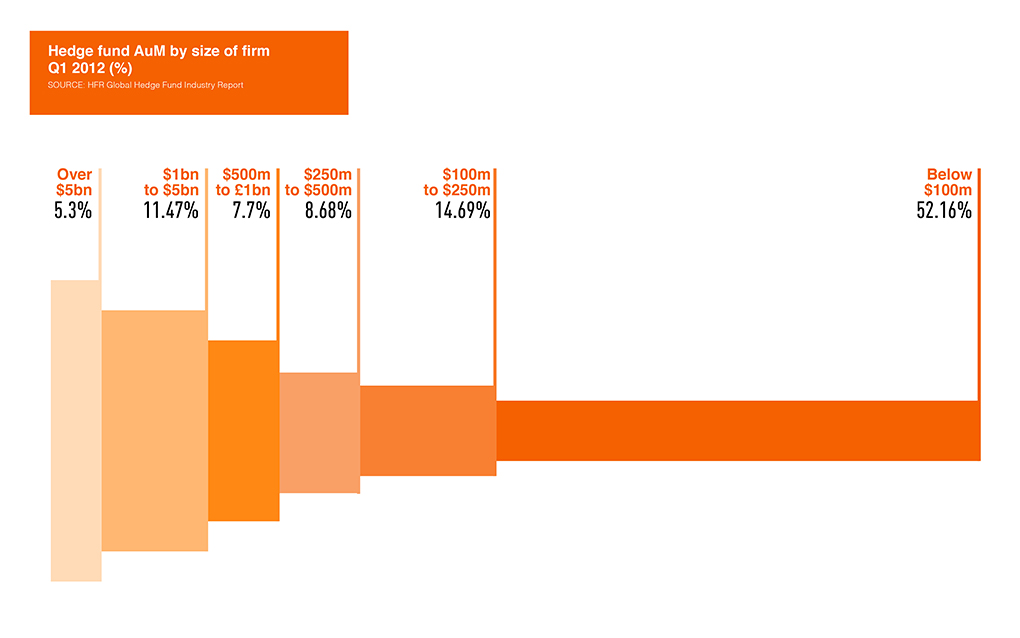

- AuM by size

- |

- GHF Sicav class A

Absolute return funds – commonly known as hedge funds – aim to ensure an investor receives a maximised absolute return on their money regardless of how the market is performing. By utilising a series of strategies to best reduce risk and to capitalise on returns an absolute return fund offers an attractive proposition to those willing to invest.

Today, more than $2.13trn is invested in hedge funds worldwide. Hedge fund managers aim to maximise a fund’s absolute return, whatever the market conditions. Hedge funds are also sometimes known as absolute return funds because they always try to deliver a positive return whether the overall market is rising or falling. The absolute return is a measurement of the gain or loss of an investment portfolio. The gain or loss will then be expressed as a percentage of invested capital. Hedge funds also make full use of a range of specialised investment techniques that are designed to provide atypically good returns regardless of overall market conditions.

Absolute Return Funds make use of a variety of strategies for reducing risk and increasing returns, among which it is worth mentioning the following strategies:

One of the most attractive aspects of the hedge fund industry is that it enables investors to tap into the talents, charisma and individual specialisations of certain absolute return fund managers and have the opportunity to profit from the expertise of these managers. The investment styles and approaches of hedge fund managers will vary from one to the other, and investors can select a manager with whose approach they feel most in harmony and in which they have confidence.

The enormous popularity of absolute return funds today shows that they have won enormous confidence among investors. Ultimately this confidence derives from the track record many hedge funds have established, given the inevitable fluctuations in performance, for achieving a high absolute return.

After all, no-one is forced to invest in an absolute return fund, yet millions of investors –including high net worth individuals and especially institutional investors –choose to do so.

About 80 percent of European hedge funds and Fund of Hedge Funds alike are based in London. But there are significant exceptions, such as Thalia, which is a highly regarded alternative investment management company based in Switzerland.

According to a British expert on the industry, the reason why so many hedge funds choose to operate from the UK capital is that, “London is the financial hub of Europe, with a depth of available talent, infrastructure, access to information, and relatively benign tax and regulatory environment that nowhere in Europe can approach.”

Section 4 below, which focuses on recent reforms in the hedge fund industry in Europe, looks at a vital European Union (EU) directive that embraces hedge funds and is having a significant impact on the industry. To state the overall regulatory situation here, within the EU – as in the US – hedge funds are in effect self-regulatory, with the advisers who manage the funds regulating the operation of the funds. In the UK, the FSA plays a vital role in the regulation of the European hedge fund industry.

In February 2012, the FSA published a report, which assessed the possible causes of systemic risk from hedge funds. In the report, the FSA emphasises that it is continually working with industry, other regulatory agencies, and organisations such as the European Securities and Markets Authority and the International Organisation of Securities Commissions, to help gain a better picture of the global hedge fund industry and to determine how some risk factors can be better measured.

The question of how investors can consistently maximise the absolute return of their investments – and indeed whether it is, in fact, feasible for any one investor or investment team to do this – is, naturally enough, a question that has greatly exercised human ingenuity.

One theory of investment markets that has exercised much influence, the Efficient Market Hypothesis (EMH), holds that in fact, the prices of investment instruments in any market will reflect all relevant available information. An important corollary of the EMH is that the entire notion that atypically high investment returns can be consistently made on an investment market is questionable; any given investor might sometimes be lucky enough to enjoy an atypically high return, but over time all investors can only expect to obtain approximately the same return.

Absolute return funds would argue, however, that by making use of a variety of investment strategies and approaches, they offer investors an ambitious and powerful investment proposition. In effect, the best hedge funds say to their investors: ‘we will deploy all our talent, experience, investment tools and know-how to bring you the opportunity to enjoy a maximised absolute return on your money whether markets and rising or falling.’

So the answer to the question: “Why do I need to know about absolute return funds?” is that this type of investment fund aims to maximise absolute return. And because hedge fund managers’ remuneration is usually substantially based on their success in generating high absolute return for investors, hedge fund managers have a fundamental vested interest in generating high absolute return.

Absolute return funds sometimes attract some disapproval during turbulent economic times, as some hedge fund investment tools – notably short-selling – can get –blamed for increasing market instability.

However, the hedge fund industry argues that hedge fund activities do nothing to undermine economic health. The industry also believes that in times of economic difficulty, absolute return funds, while pursuing investment strategies designed to maximise returns both in a rising and falling market, will to some extent suffer along with everyone else.

In Europe, regulation of the hedge fund industry is rigorous and wide-ranging. It is usually carried out at a national level by the country’s respective national bank or leading investment authority, frequently following directives issued by the EU, at least if the nation is a member of the EU.

A particularly important piece of legislation was passed by the EU in November 2010. This, the Alternative Investment Fund Managers Directive (AIFMD) established a new, consistent, regulatory framework across the entire EU for alternative investment funds, including hedge funds. One of the main provisions of the AIFMD was that all EU hedge fund managers must register with national regulatory authorities. Overall, according to the EU, the aim of the AIFMD was to furnish greater monitoring and more effective control of alternative investment funds.

The AIFMD was designed to:

Countries within the EU are required to adopt the directive in national legislation by early 2013. In practice, within the EU, different member nations have adopted varying regulatory approaches to the hedge fund industry. Some member nations have imposed restrictions on some aspects of hedge fund activities, including use of short-selling, derivatives and leverage. It is impractical to try to provide a completely up-to-date account of various EU member nations’ restrictions of hedge fund activities, as the bans are often imposed only on a short-term basis – sometimes for as little as a week or two – to coincide with particular market conditions.

It is also important to note that the Undertakings for Collective Investments in Transferable Securities, (Directive 2001.107.EC) and 2001/108.EC – also known within the hedge fund industry as ‘UCITS’ are a set of European directives allowing collective investment schemes the right to operate freely throughout the EU, given that the scheme in question has received single authorisation from one member state.

The very nature of absolute return funds puts an enormous premium on human investment expertise, knowledge and sheer instinctive flair for generating high absolute returns. The best hedge fund organisations place a high emphasis on hiring talented and experienced hedge fund managers. Thalia’s GHF Sicav Global Macro Fund Class A won the award for Best Global Macro FoHF in the World Finance Hedge Fund Awards, 2012.

Alternative investment management company Thalia seeks to maximise absolute return not only by selecting extremely talented absolute return fund managers, but also by creating ‘funds of funds’ that allow a particular investment vehicle to embody the expertise of several hedge fund managers, while reducing the risk embedded in a single hedge fund investment. Thalia is based in Lugano, in the Italian-speaking area of Switzerland known as Ticino.

Founded in 2003, Thalia is 51 percent owned by BSI SA – one of the oldest and most respected banks in Switzerland – and 49 percent by Generali Investments, a leading investment manager in Europe. As of the end of June 2012, Thalia had about $2.1bn under management or advisory across seventeen different programmes.

During its nine years existence, Thalia has won many international awards that are testament to the solidity of its investment process and portfolio construction. Significant awards that Thalia has recently won include, the ‘Global Banking & Financial Review Award 2012’, which was given to the GHF Sicav Arbitrage Opportunities, the GHF Sicav Fixed Income and to the GHF Sicav Global Macro.

The GHF Sicav Global Macro has also won the World Finance Award 2012 as the best fund of hedge fund in its category. Furthermore, the GHF Sicav Fixed Income and the GHF Sicav Global Macro have also won the ‘Investhedge Award’ 2011 as the best FOHFs in their respective categories.

Thalia is somewhat different from other FOHFs providers. Thalia’s competitive hedge is based on the following strengths:

A primary way in which Thalia wins a competitive edge is that each fund Thalia manages has its own portfolio manager who is also a senior analyst. This portfolio manager will have a detailed and specialised knowledge of whatever strategy, or group of strategies, the fund of funds is pursuing.

Thalia is deeply conscious of the areas where it believes it can achieve a significant competitive edge over other absolute return fund organisations. It emphasises that its owners “have committed significant capital to Thalia’s products with a medium-long term investment horizon.” Thalia also offers a disciplined, independent and dynamic investment process which integrates qualitative investment due diligence, operational due diligence and quantitative risk management.

Subsequently, Thalia has never been exposed to fraud and runs its business in a fully transparent way and operating in a client confidential manner. Investment team expertise is also a vital competitive edge that Thalia. The organisation emphasises that each member of its investment team has, on average, ten years’ experience in working in financial markets and in absolute return fund investing. The team has been working together for an average of six years, and staff turnover has been very limited in that period. Additionally, Thalia points to its important contacts with established top-tier managers who are frequently close to new investments.

Thalia currently runs seventeen FOHFs as portfolio manager of which eleven are comprised in Thalia’s off-the-shelf-product range. Thalia’s products include:

Thalia also offers significant expertise in absolute return fund due diligence, and advisory services that embrace advising clients generally in connection with the overall investment process, portfolio construction and in management of funds.

Generally, Thalia provides a powerful proposition to all kinds of investors in absolute return funds, and especially to institutional investors, including pension funds, seeking assistance with creating and managing a hedge fund or investing in a Thalia hedge fund of funds. Thalia currently has numerous important client mandates from high net worth individuals and major institutional investors.

As Thalia succinctly puts it: the organisation’s “portfolio construction integrates the level of conviction and risk management considerations.”

For further information on Thalia:

www.thaliainvest.com